A beautifully curated space for people who are ready to understand their lives, their benefits, and their future with confidence.

Your journey toward clarity doesn’t begin in a meeting. It begins here, where information feels organized, support feels accessible, and everything finally starts making sense.

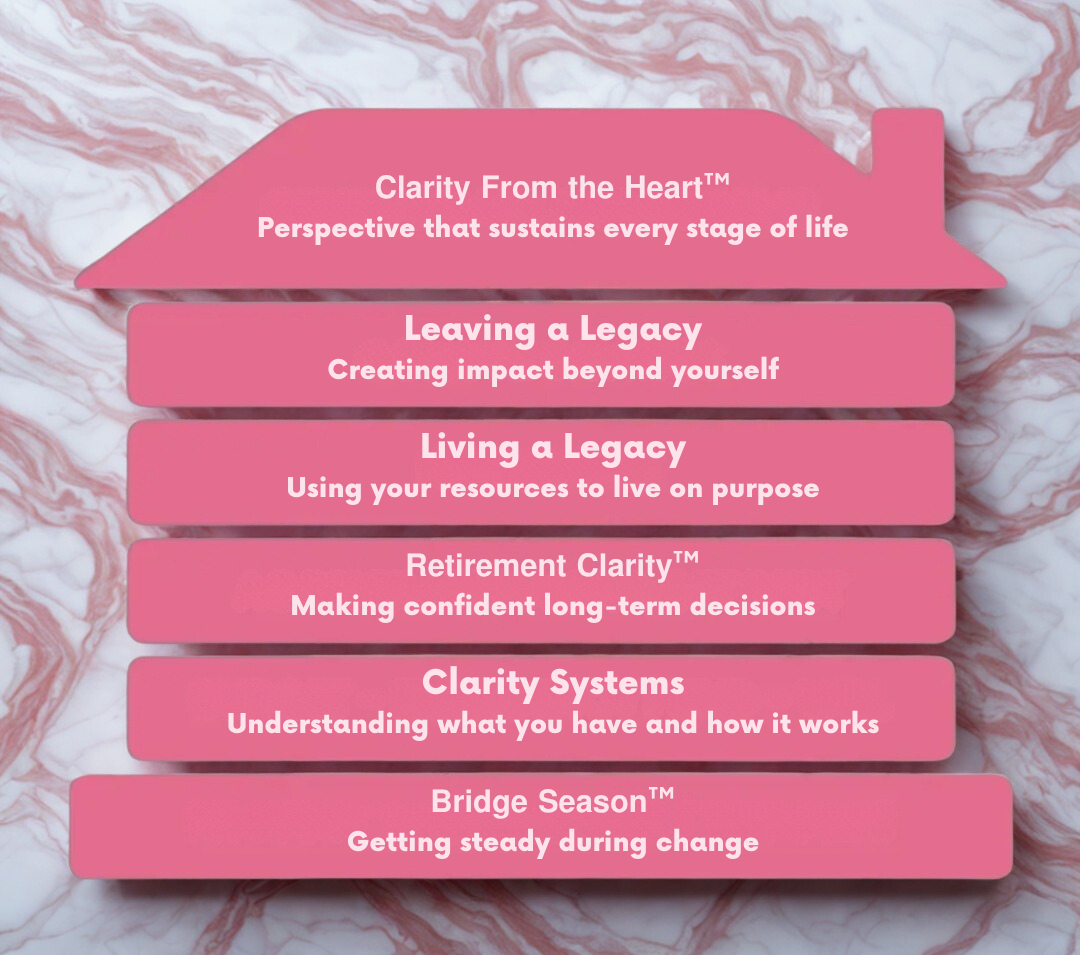

Every section below is designed to help you rise into a version of yourself who moves with confidence, awareness, and ease.

Let’s begin.

🌸 CLARITY RESOURCE CENTER™

-

Before I had clarity, what felt most overwhelming wasn’t money itself; it was realizing how little I understood about the retirement account I was relying on. As a public school educator, I assumed I had a 403(b), only to later learn it was actually a 401(a), and that difference mattered more than I ever imagined.

I was doing what I thought was right: contributing consistently from my paycheck and trusting the system to take care of my family in retirement or if something happened to me. I wasn’t afraid or avoiding my account; I was simply unaware. I believed the story many of us were taught: go to school, get a good job, fund your retirement, and everything will work out.

That belief was challenged during a financial hardship, when I tried to access my own money and was told I couldn’t because the account was a defined benefit contribution and the company controlled both access and outcomes, including what would happen to my beneficiaries. After nearly 20 years of work, I realized I didn’t truly own the money I was counting on to protect my family.

What changed everything was learning that financial responsibility means ownership: owning your money, owning your retirement strategy, and owning the decisions that affect your family. Once I understood my options and established accounts in my own name, the fear disappeared. What replaced it was relief, confidence, and pride.

That experience is why I built the Clarity Resource Center™ - so people don’t give up control of their future, their access, or their legacy simply because no one ever explained the rules.

-

A judgment free conversation where your questions finally have space to breathe.

A Clarity Session is a private, guided conversation where we walk through your retirement picture, one piece at a time. You bring your questions, worries, enthusiasm about the possibilities, and “I have no idea what this means” moments. I bring licenses, structure, explanations, direction, and clarity.

We may talk about:

Work retirement plans and old accounts

Beneficiaries and paperwork you have never really looked at

Retirement timelines and what you want life to feel like later

Next steps that fit your reality, not someone else’s script

What early retirement might look like for you

No quizzes. No pressure. No rushing. Just time set aside for you.

-

Finding old money can feel exciting, but it’s also a moment that deserves pause.

Many people make fast decisions that lead to avoidable taxes, unnecessary penalties, or lost growth.Found money is a blessing. How you handle it determines whether it grows or disappears.

If you locate an old account, pension, or unclaimed funds:

• Write down the details (company name, account number, benefit type)

• Do not move it yet

• Capture the questions you have about options and timingThis is not about rushing. It is about making an intentional decision.

-

Use these trusted tools to search for retirement accounts, pensions, or funds that may have been left behind.

💗 Find lost retirement accounts from prior employers

Retirement Savings Lost and Found (U.S. Department of Labor)💗 Search for unclaimed money held by your state

Unclaimed Funds by State💗 Locate missing or forgotten pension benefits

Pension Benefit Guaranty Corporation (PBGC)💗 Search for life insurance policies you may not know about

NAIC Life Insurance Policy LocatorIf you find something, pause. Do not move it yet.

-

Some documents do not belong in a pile, a box, or that messy kitchen drawer that holds everything. 𝗧𝗵𝗲𝘆 𝗯𝗲𝗹𝗼𝗻𝗴 𝗶𝗻 𝗮 𝘀𝗮𝗳𝗲 𝘀𝗽𝗼𝘁 𝘆𝗼𝘂 𝗰𝗮𝗻 𝗳𝗶𝗻𝗱.

If you use a fireproof safe or fireproof envelope, consider protecting:

Copies of retirement plan statements or summaries

Life insurance policy information and contact numbers

Beneficiary pages or confirmations

Key legal documents like wills, trusts, or powers of attorney

A simple list of your major accounts and where they are held

You do not have to organize it perfectly. Even gathering items into one secure place is a powerful first step.

A fireproof envelope or safe keeps your essentials in one place for emergencies, transitions, and peace of mind.

Also consider keeping:

💗 Birth certificates

💗 Social Security cards

💗 Other insurance policies

💗 Passports and copies of IDs

💗 Medical or school records

💗 Emergency contacts 💗 Survivor’s GuideThis is not about perfection.

This is about readiness. -

Some of the most important facts about your future are held by government agencies.

These trusted tools give you a clear, reliable starting point.💗 Social Security Retirement Benefits

Learn about benefit options and create or access your my Social Security account.💗 IRS Retirement Plans Information

High-level explanations of different retirement plan types and rules.💗 Employee Benefits Security Administration (EBSA)

Official U.S. Department of Labor resources on retirement benefits and protections.💗 Pension Benefit Guaranty Corporation (PBGC)

Information and search tools for certain pensions that may still be held for you.💗 Thrift Savings Plan (TSP)

Official retirement plan site for federal employees and uniformed services.You do not have to read everything. Even opening one link and saving it for later is progress.

💗 When you want help connecting it all, book a Clarity Session.

-

Clear answers often begin with simple questions.

If you work for a school district, company, or organization, these questions help uncover key benefit details:

• What retirement plans are available here?

• Who is the provider for my plan?

• Do we offer a Roth option?

• Is there employer matching?

• How do I update beneficiaries?

• Has the provider changed names?

• How do I request full plan history?These are the same questions I walk through with employees during district-approved education sessions and 1:1 clarity reviews.

If HR answers feel incomplete, that is not a failure. It is a signal to get support.

-

Not8every term needs to be mastered, but understanding a few key words can change how your benefits finally make sense.

Here are terms that come up often:

Contribution

Rollover

Beneficiary

Distribution

Allocation

Vesting

Match

Pretax

Roth

Required Minimum Distribution

Provider

Plan Sponsor

Use these trusted glossaries anytime you see a word that feels unfamiliar.

💗 IRS Glossary

Clear definitions directly from the Internal Revenue Service.💗 Benefits and Retirement Glossary (Social Security Administration)

Plain-language definitions for common workplace benefit and retirement terms.💗 SEC Investor Glossary

Investment definitions from the U.S. Securities and Exchange Commission.If a word catches your eye or makes you pause, that is your invitation to explore it with support.

You deserve clarity you understand. -

𝗬𝗼𝘂 𝗱𝗼 𝗻𝗼𝘁 𝗵𝗮𝘃𝗲 𝘁𝗼 𝗯𝗲 “𝗼𝗿𝗴𝗮𝗻𝗶𝘇𝗲𝗱” 𝘁𝗼 𝘀𝘁𝗮𝗿𝘁. 𝗬𝗼𝘂 𝗷𝘂𝘀𝘁 𝗵𝗮𝘃𝗲 𝘁𝗼 𝗯𝗲 𝗿𝗲𝗮𝗱𝘆 𝗳𝗼𝗿 𝗰𝗹𝗮𝗿𝗶𝘁𝘆.

If you are:

Carrying questions in your mind

Wondering if you are missing something important

Sitting on old accounts or paperwork

Tired of trying to figure this out on your own

Then, your next move is simple:

𝗬𝗼𝘂𝗿 𝗳𝘂𝘁𝘂𝗿𝗲 𝗱𝗼𝗲𝘀 𝗻𝗼𝘁 𝗻𝗲𝗲𝗱 𝗽𝗲𝗿𝗳𝗲𝗰𝘁𝗶𝗼𝗻. 𝗜𝘁 𝗻𝗲𝗲𝗱𝘀 𝗱𝗶𝗿𝗲𝗰𝘁𝗶𝗼𝗻.